As I explore my options for securing my financial future, I appreciate the role that comprehensive insurance solutions play. Founded by Lina M. Bockar, CPIA, and her brother Jose L. Blanco, P&C Agency Director, El Bodegon LLC offers a unique blend of professional expertise and cultural understanding.

I find it particularly appealing how their strategic locations within supermarkets facilitate access to quality insurance services while handling daily shopping needs. This approach is especially beneficial for the Hispanic and international communities in Palm Beach County.

The company’s commitment to finding the most appropriate financial services through diverse carriers and customized policies resonates with my search for reliable coverage. With a focus on serving the community, El Bodegon LLC has become a trusted provider.

Key Takeaways

- Comprehensive insurance solutions tailored to the Hispanic and international communities.

- Strategic locations within supermarkets for convenient access.

- A blend of professional expertise and cultural understanding.

- Diverse range of carriers and customized policies.

- Commitment to serving the community and securing financial futures.

Understanding El Bodegon Insurance & Financial Services LLC

In the realm of insurance and financial services, El Bodegon Insurance & Financial Services LLC is a name that resonates with reliability and customer-centric service. With a strong presence in the community, the company has established itself as a trusted partner for individuals and businesses seeking comprehensive insurance solutions.

The Founding Story and Mission

El Bodegon Insurance & Financial Services LLC was founded on a straightforward mission: to pinpoint and mitigate clients’ risk exposure. This is achieved by prioritizing high-quality coverage, competitive premiums, and streamlining insurance processes. The company’s commitment to excellence is reflected in its dedication to serving the Hispanic and international communities in the Lake Worth area with culturally sensitive insurance services.

Our Commitment to the Hispanic and International Communities

The company’s bilingual staff makes clients feel comfortable discussing their insurance needs in their preferred language, eliminating communication barriers that often complicate insurance processes. El Bodegon Insurance & Financial Services LLC builds lasting relationships within the community through educational workshops, community events, and personalized attention to each client’s unique situation.

- I value El Bodegon’s dedication to serving the Hispanic and international communities in the Lake Worth area with culturally sensitive insurance services.

- Their bilingual staff makes me feel comfortable discussing my insurance needs in my preferred language, eliminating communication barriers that often complicate insurance processes.

- I appreciate how they’ve tailored their customer service approach to address the specific concerns and priorities of diverse community members like myself.

- Their commitment extends beyond just selling policies – they educate clients about insurance concepts and options in culturally relevant ways.

- I’ve noticed how El Bodegon financial services LLC builds lasting relationships within the community through educational workshops, community events, and personalized attention to each client’s unique situation.

Our Strategic Locations in Palm Beach County

El Bodegon Insurance & Financial Services LLC has expanded its presence in Palm Beach County with strategic locations. This expansion is a testament to the company’s commitment to making its insurance and financial services more accessible to a wider audience.

As a financial services LLC, El Bodegon is dedicated to providing comprehensive solutions to its customers. The strategic locations enable the company to cater to the diverse needs of its clientele across different regions.

Lake Worth Beach Location at Military Trail and Lake Worth Road

The Lake Worth Beach location is situated at the intersection of Military Trail and Lake Worth Road, making it a convenient spot for customers in the area. This location is part of the El Bodegon grocery store setup, allowing customers to combine their shopping with insurance and financial services.

I appreciate how this location maintains high standards of customer care, providing personalized services that meet the specific needs of the local community.

Forest Hill Boulevard and Military Trail Location

As our business expanded and the demand for our products and services increased, Lina Bockar and Jose Blanco opened a second location within the EL BODEGON Supermarket on Forest Hill Blvd. and Military Trail. This additional location demonstrates the company’s growth and the increasing demand for its specialized bodegon insurance financial services.

- The new location provides me with the same comprehensive services in a convenient setting, combining shopping and insurance solutions.

- Both locations are strategically positioned to serve the diverse Lake Worth community, making quality insurance accessible to more residents.

- I appreciate the high standards of customer care maintained at both locations, catering to the specific needs of their local communities.

Comprehensive Health Insurance Solutions

Navigating the complex world of health insurance can be challenging, but with El Bodegon LLC, you’re in good hands. We offer a range of health insurance solutions designed to meet the diverse needs of our clients, from individuals to businesses.

Private Market Health Insurance Policies

For those seeking health insurance outside of the marketplace, El Bodegon LLC provides private market health insurance policies that offer flexibility and personalized coverage. These plans are ideal for individuals and families who don’t qualify for or prefer not to use the marketplace. Our team will work closely with you to understand your health insurance needs and budget, ensuring you get the right coverage.

Marketplace Plan Health Insurance (“Obamacare”)

El Bodegon LLC is here to assist you in navigating the Marketplace Plan Health Insurance, commonly known as “Obamacare.” We help you understand the various plans available, including their benefits, costs, and eligibility criteria. Our goal is to ensure you find a plan that fits your health needs and financial situation.

Group Health Insurance Programs for Businesses

For businesses, offering group health insurance can be a valuable tool for attracting and retaining top talent. El Bodegon LLC specializes in establishing group health insurance programs tailored to the size and needs of your business. Our insurance financial services team will guide you through the process, from selecting the right plan to managing renewals and employee enrollment.

By choosing El Bodegon LLC for your health insurance needs, you benefit from our expertise in insurance services and financial services. We are committed to providing you with comprehensive coverage that is both cost-effective and sustainable for your business or personal situation.

Homeowners Insurance: Protecting My Most Valuable Asset

For many, their home is their most valuable asset, making homeowners insurance a vital consideration in Lake Worth. As a homeowner, it’s essential to understand the intricacies of insurance coverage to safeguard your property effectively.

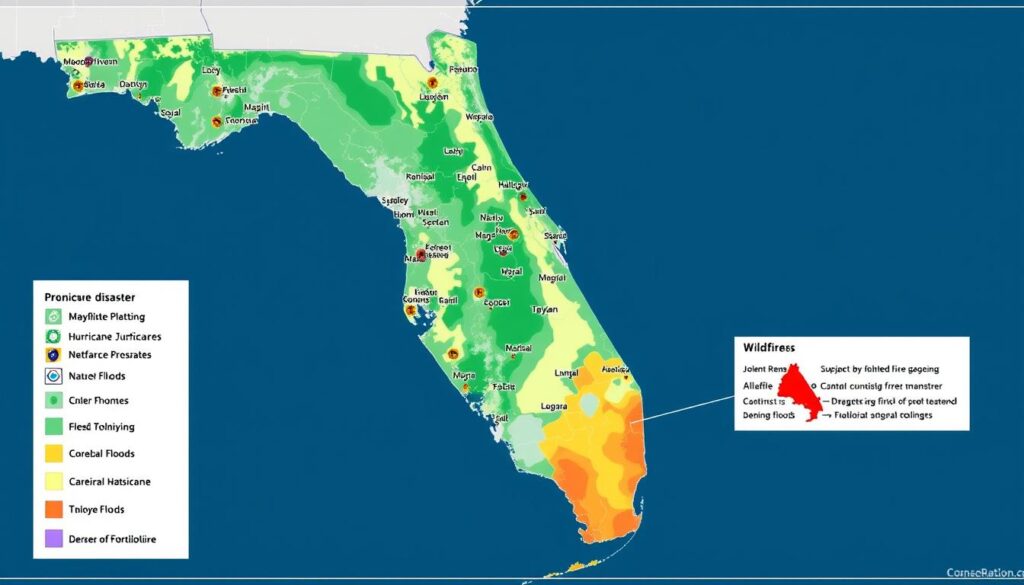

Understanding Coverage Options for Florida Homeowners

Florida homeowners face unique challenges, from hurricanes to flooding. El Bodegon Insurance offers comprehensive coverage options tailored to the specific needs of Lake Worth residents. Their experts guide you through the process, ensuring you have the right protection for your home.

With El Bodegon’s insurance financial services, you can rest assured that your most valuable asset is protected. Their team explains the various coverage options, helping you make informed decisions about your home’s insurance.

Maximizing Credits Through Proper Inspections and Reports

Proper home inspections and documentation can significantly reduce your homeowners insurance premiums. El Bodegon’s financial services LLC experts recommend wind mitigation inspections, roof certifications, and other reports to qualify for insurance discounts.

- I’ve learned from El Bodegon financial services LLC that proper home inspections and documentation can significantly reduce my homeowners insurance premiums in the Lake Worth area.

- Their services LLC experts guide me through the process of obtaining wind mitigation inspections, roof certifications, and other reports that can qualify my home for insurance discounts.

- I appreciate how their insurance financial services team explains which home improvements might qualify for additional credits, helping me make cost-effective decisions about upgrades.

- The services inc professionals at El Bodegon help me understand how factors like my home’s construction materials, roof age, and hurricane protection features affect my insurance rates.

- I value Bodegon Insurance‘s proactive approach in recommending the specific inspections and documentation that will maximize my credits while ensuring I maintain appropriate coverage for my home’s specific risks.

By working with El Bodegon Insurance, Lake Worth homeowners can ensure they have the right coverage in place, protecting their most valuable asset from unforeseen events.

Auto Insurance Solutions Tailored to My Needs

El Bodegon LLC offers personalized auto insurance solutions tailored to the unique needs of Lake Worth, Florida residents. With a deep understanding of the local market, their team is dedicated to providing comprehensive coverage options that protect you and your assets.

Personal Auto Insurance Coverage Options

For individuals, El Bodegon LLC provides a range of personal auto insurance coverage options. Their insurance financial services team helps you understand the different types of coverage available, including liability, collision, and comprehensive coverage. By assessing your specific needs, they can recommend the most suitable policy for you.

- Liability coverage to protect you in case of an accident

- Collision coverage to repair or replace your vehicle

- Comprehensive coverage for non-accident related damages

Commercial Vehicle Insurance for Business Owners

As a business owner in Lake Worth, you require more than just personal auto insurance. El Bodegon LLC’s financial services expertise helps you secure appropriate commercial vehicle insurance for your company vehicles. Their team assesses your business operations to determine the right coverage types and limits, considering factors like vehicle types, usage patterns, and drivers.

- Protection for your business assets in case of an accident

- Compliance with state requirements for commercial vehicle insurance

- Coverage for liability claims related to your business vehicles

By choosing El Bodegon LLC for your auto insurance needs, you benefit from their insurance financial services expertise and commitment to the local community, including their convenient location near a grocery store in Lake Worth. Whether you’re an individual or a business owner, such as a group inc, they provide tailored solutions to ensure you have the right coverage.

Business Insurance: Safeguarding My Enterprise

As a business owner in Florida, I need comprehensive insurance coverage to safeguard my enterprise. El Bodegon LLC provides business insurance solutions tailored to the unique needs of Florida businesses. Their expertise helps me understand the various risks my business may face and the coverage options available.

General Liability and Property Insurance

General liability insurance protects my business from claims of bodily injury, property damage, and personal injury. El Bodegon LLC’s financial services experts help me understand how this coverage can safeguard my business assets. Property insurance covers damage to my business property due to various risks such as fire, theft, or natural disasters. Their insurance financial services team tailors recommendations to my specific business needs.

Workers’ Compensation Coverage

I understand that workers’ compensation insurance is crucial for businesses with employees, as it covers work-related injuries and illnesses. El Bodegon services LLC helps me navigate the complexities of workers’ compensation laws in Florida, ensuring I comply with state regulations. Their costumer-focused approach makes it easier for me to understand my obligations and the benefits of this coverage.

Professional Liability Insurance

I appreciate how El Bodegon LLC’s insurance financial specialists help me understand the importance of professional liability insurance, also known as errors and omissions insurance. This coverage protects my business from claims of negligence, mistakes, or failure to perform professional duties. Their team tailors recommendations to my specific industry, recognizing that professional liability risks vary significantly between medical, legal, financial, design, and other professional fields.

- I understand that as a professional service provider, I face unique risks that require specialized coverage, which is why I consult with El Bodegon services LLC about professional liability insurance.

- Their financial services experts help me understand how professional liability insurance protects my business from claims of negligence, mistakes, or failure to perform professional duties.

- I appreciate how their insurance financial services team tailors recommendations to my specific industry, recognizing that professional liability risks vary significantly between medical, legal, financial, design, and other professional fields.

- Their insurance financial specialists help me determine appropriate coverage limits based on my risk exposure, client contracts, and industry standards.

- After visiting their grocery store location, I feel confident in my professional liability coverage and appreciate their costumer-focused approach to explaining complex insurance concepts in accessible terms.

Life Insurance and Financial Planning Services

El Bodegon LLC offers comprehensive life insurance and financial planning services tailored to your needs in Florida. Their team of experts is dedicated to helping you achieve your long-term financial goals.

Term Life Insurance Options

Term life insurance provides coverage for a specified period, offering a death benefit if you pass away during the term. El Bodegon LLC’s financial services professionals can help you choose the right term life insurance policy that fits your needs and budget. They offer flexible term lengths and coverage amounts to suit various financial situations.

Whole Life and Universal Life Policies

Whole life and universal life insurance policies provide lifetime coverage and a cash value component. The insurance financial services team at El Bodegon LLC can guide you through the benefits and features of these policies, helping you make an informed decision. These policies can be an essential part of your overall financial strategy.

Retirement Planning and Investment Services

Planning for retirement is a crucial aspect of financial planning. El Bodegon LLC’s financial services include retirement planning and investment strategies tailored to your goals and risk tolerance. They help you understand various retirement vehicles, such as 401(k)s, IRAs, and annuities, and how they can fit into your overall retirement plan.

I’m working with El Bodegon services LLC to develop a comprehensive retirement strategy that aligns with my long-term financial goals and risk tolerance. Their financial services professionals help me understand various retirement vehicles and how each might fit into my overall retirement plan.

The bodegon insurance advisors help me analyze my current savings rate, projected retirement needs, and potential income sources to identify any gaps in my retirement planning. I value their holistic approach to retirement planning that considers not just accumulating money for retirement but also protecting those assets and creating sustainable income streams for my post-working years.

Specialized Insurance Solutions for Unique Needs

At El Bodegon LLC, we understand that unique needs require specialized insurance solutions, particularly in a state like Florida that’s prone to various natural disasters. Our range of insurance products is designed to address the specific challenges faced by Floridians.

Flood Insurance in Florida’s Vulnerable Areas

Florida’s vulnerability to flooding makes flood insurance a critical consideration for homeowners, especially in areas near the coast or with low elevation. El Bodegon LLC offers flood insurance policies that provide comprehensive coverage against flood-related damages.

Umbrella Insurance for Extended Liability Protection

For individuals and businesses seeking additional liability protection beyond what’s offered by standard insurance policies, umbrella insurance is a valuable option. El Bodegon LLC’s umbrella insurance policies provide extended coverage to help protect your assets in case of unexpected events.

Boat and Recreational Vehicle Coverage

Whether you’re enjoying your boat on Lake Worth or taking your RV on a trip to Latin America, El Bodegon LLC’s insurance financial services have got you covered. We offer specialized insurance for boats and recreational vehicles, protecting your investments against damage, theft, or liability.

Our experts at El Bodegon financial services LLC can help you understand the unique risks associated with your watercraft or recreational vehicle and tailor a policy to fit your needs, whether you’re cruising in Florida or traveling abroad.

By visiting our office, even during a grocery store visit, you can discuss your insurance needs with our knowledgeable team and feel confident that your investments are properly protected.

The El Bodegon Insurance Advantage: Why Choose Our Services

With El Bodegon Insurance, you gain a partner who understands your insurance needs and provides tailored solutions. Our approach is centered around you, ensuring that you receive the best possible insurance coverage.

Bilingual Services and Cultural Understanding

At El Bodegon Insurance, we pride ourselves on our ability to serve the Hispanic and international communities. Our bilingual services ensure that language barriers do not hinder your ability to secure the right insurance coverage. Our team understands the cultural nuances that can impact your insurance needs, allowing us to provide more personalized and effective solutions.

- We cater to a diverse clientele, ensuring that everyone feels understood and valued.

- Our bilingual staff can assist you in your preferred language, making the insurance process smoother and more accessible.

- Our cultural understanding enables us to anticipate and address your unique insurance needs.

Personalized Risk Assessment and Coverage Recommendations

Our insurance financial services team takes a thorough approach to assessing your specific risk profile before recommending insurance solutions. We understand that each individual or business has unique circumstances, including assets, family situation, future plans, and risk tolerance.

- We take the time to understand your unique circumstances, rather than offering one-size-fits-all solutions.

- Our advisors explain the reasoning behind their recommendations, helping you understand the specific risks you face and how each coverage option addresses those concerns.

- We encourage your questions and provide clear, straightforward answers to help you make informed decisions about your coverage.

- Our ongoing relationship approach includes regular reviews to ensure your insurance protection evolves alongside changes in your life, assets, and financial goals.

By choosing El Bodegon Insurance, you benefit from our commitment to providing financial services LLC that are tailored to your needs, ensuring that you receive the best possible insurance coverage in Lake Worth and beyond.

Our Insurance Carrier Network and Partnership Benefits

Our ability to offer comprehensive insurance solutions stems from our established relationships with a variety of insurance carriers. This diverse network enables us to provide tailored policies that meet the specific protection needs of our clientele.

Access to Multiple Insurance Providers

At El Bodegon LLC, we pride ourselves on having access to multiple insurance providers. This allows us to offer a broad spectrum of insurance products, ensuring that our clients can choose the coverage that best suits their needs. Whether it’s health, auto, home, or business insurance, our connections with various carriers mean we can provide competitive options.

- We can offer a range of policies from different carriers, giving clients flexibility in their insurance choices.

- Our clients benefit from our ability to compare policies across multiple insurers, ensuring they receive the best coverage.

Competitive Rates Through Strong Carrier Relationships

Our strong relationships with insurance carriers translate into competitive rates for our clients. By leveraging our agency’s volume and good standing with carriers, we secure favorable terms for our clients in the Lake Worth area. Our insurance financial services specialists work closely with clients to understand their needs and provide personalized risk assessment and coverage recommendations.

- I enjoy competitive insurance rates through El Bodegon’s financial services team, who leverage their strong carrier relationships to secure favorable terms.

- The bodegon insurance professionals answer my questions about pricing factors, helping me understand how my choices and carrier selection affect my premium costs.

- After visiting their grocery store location, I understand how their independent agency model works to my advantage by prioritizing my needs.

By maintaining strong relationships with multiple insurance carriers, we at El Bodegon LLC are able to provide our clients with comprehensive insurance solutions, competitive rates, and personalized service, making us a trusted partner in the community.

Client Success Stories: Real Protection in Action

Through our work at El Bodegon, we’ve witnessed numerous instances where appropriate insurance coverage has been the key to recovery and stability for our clients. Our team has helped individuals and businesses navigate complex claims and unforeseen events, providing them with the support they need during difficult times.

Homeowner Claims Resolution Testimonials

Our clients have experienced significant relief when we’ve helped them resolve homeowner claims efficiently. For instance, one homeowner faced a substantial loss due to property damage but was able to recover fully thanks to their comprehensive insurance plan. The claims process was handled smoothly by our dedicated team, ensuring that our client could repair their property without undue stress or financial burden.

Another client appreciated how our bilingual services facilitated communication, making it easier for them to understand the claims process and the coverage provided by their policy. These testimonials highlight the value of having the right insurance coverage and a supportive insurance partner like El Bodegon.

Business Insurance Protection Stories

Business owners have also benefited greatly from our insurance services. One of our clients, a grocery store operator, faced a significant loss due to a liability claim. Thanks to their business insurance policy, they were able to defend against the claim without financial ruin. Our team worked closely with them to navigate the complex claims process, minimizing disruption to their operations.

These success stories demonstrate the practical value of our services in protecting business investments and ensuring continuity after unexpected events. By providing personalized risk assessment and coverage recommendations, we help businesses safeguard their future.

Understanding the Insurance Process: From Quote to Claim

El Bodegon LLC is committed to making the insurance process transparent and hassle-free, from the initial quote to the final claim settlement. “We believe in providing a seamless experience for our clients,” says El Bodegon LLC. This commitment is reflected in every step of our insurance services.

Getting Started with a Personalized Quote

To begin, getting a personalized quote is straightforward. Simply contact us at (561)227-2332 to start the process. Our team at El Bodegon services LLC will guide you through the necessary steps, ensuring that you receive a quote tailored to your specific needs.

Policy Management and Updates

Once your policy is in effect, managing it is easy. You can update your policy details, make payments, and access your documents through our user-friendly platform. Our insurance services team is always available to assist you with any questions or changes.

The Claims Process Made Simple

Filing a claim can be a stressful experience, but with El Bodegon, it’s made simple. Our team explains what to expect during the claims process, from initial reporting through assessment, settlement, and resolution. As one of our clients appreciated, “I value how their insurance financial services specialists serve as my advocates with insurance carriers, helping ensure my claim is properly documented, fairly evaluated, and promptly settled.” You can visit us at our 4481 Lake Worth location for personalized support.

By choosing El Bodegon LLC, you’re not just purchasing insurance; you’re gaining a dedicated partner who will guide you through every step of the insurance process.

Frequently Asked Insurance Questions Answered

At El Bodegon Insurance, we understand that navigating insurance options can be overwhelming, so we’re here to address your most pressing questions. Our goal is to provide clarity and confidence as you make informed decisions about your insurance needs.

Common Health Insurance Concerns

Health insurance is a critical aspect of financial planning. Common questions include understanding the differences between private market health insurance policies and marketplace plans, as well as the benefits of group health insurance programs for businesses. Our financial services LLC experts are here to guide you through these options.

- What are the key differences between individual and group health insurance plans?

- How do I choose the right marketplace plan for my needs?

Homeowners Insurance Clarifications

Understanding homeowners insurance is crucial for protecting your most valuable asset. We clarify coverage options for Florida homeowners, including maximizing credits through proper inspections and reports. Our bodegon insurance advisors help you navigate these complexities.

| Coverage Type | Description | Benefits |

|---|---|---|

| Dwelling Coverage | Covers the structure of your home | Repairs or rebuilds your home in case of damage |

| Personal Property Coverage | Covers your personal belongings | Replaces or repairs damaged or stolen items |

Auto and Business Insurance Questions

Our services LLC experts clarify business insurance concerns, explaining the differences between various liability coverages and how they protect different aspects of your business operations. We also address questions about auto insurance requirements, optional coverages, and factors affecting your premiums, providing costumer-focused answers.

- What are the minimum auto insurance requirements in Florida?

- How do I determine the right level of business liability coverage?

By addressing these common questions, we aim to empower you with the knowledge needed to make informed decisions about your insurance coverage. At El Bodegon Insurance, our commitment is to provide you with the financial services and guidance you need to secure your future.

Securing My Future: Taking the Next Step with El Bodegon Insurance

Taking control of my financial future is simple with El Bodegon Insurance’s tailored insurance solutions and expert guidance. I’m ready to take the next step in securing my financial future by consulting with El Bodegon Services LLC about comprehensive insurance protection tailored to my specific needs.

Their financial services team makes it easy to get started through a no-obligation consultation where I can discuss my concerns, ask questions, and explore coverage options. I appreciate how their insurance financial services approach focuses on education and understanding rather than high-pressure sales tactics, allowing me to make confident decisions about my protection.

Visiting their convenient Lake Worth location, situated near a grocery store, makes it simple to stop by during my regular shopping trips. Alternatively, I can call (561)227-2332 to schedule a dedicated appointment. By working with El Bodegon, I understand that I’m gaining not just insurance policies but a long-term relationship with services professionals who will help my coverage evolve alongside my changing life circumstances.

Taking this step gives me peace of mind knowing that I have expert guidance in navigating the complex insurance landscape and protecting what matters most to me and my family. With El Bodegon Insurance, I’m confident in my ability to secure my future.

To get started, I can contact El Bodegon Insurance at (561)227-2332 to schedule a consultation and take the first step towards comprehensive insurance protection.